I’ll be taking a break from this blog and my JiveTalking podcast for the next two weeks. If you have any ideas for posts — or guests on my podcast (you?), then please leave a comment or email me!

See you on January 3, 2022!

Sometimes you just want the answer

I’ll be taking a break from this blog and my JiveTalking podcast for the next two weeks. If you have any ideas for posts — or guests on my podcast (you?), then please leave a comment or email me!

See you on January 3, 2022!

H/T to PB and IT

I’ve been revising a paper on the potential impacts of increasing water scarcity (driven by climate change as well as other unsustainable practices). One of the areas facing the greatest risk is agriculture, and thus food production and food (in)security.

This weekend I read that “food prices hit 46-year high,” which is not a good sign. It gets worse:

The high prices come despite expectations that total global production of grains in 2021 will set an all-time record: 0.7% higher than the previous record set in 2020. But because of higher demand (in part, from an increased amount of wheat and corn used to feed animals), the 2021 harvest is not expected to meet consumption requirements in 2021/2022...

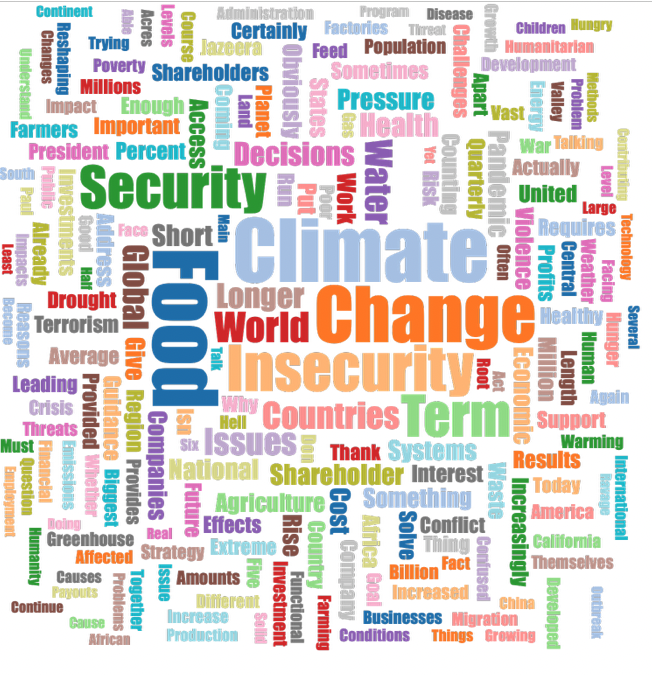

Since I am interested to see if this is “just me” or a sign of an increasing trend, I wanted to look into n-grams on this topic. The most famous — Google’s n-gram viewer — is for books, so I found one that focusses on TV news coverage (using captions 🙂 and got this “density function” for the string food AND (security OR insecurity) AND climate:

Here’s a word cloud from the transcripts linked to the search:

My one-handed conclusion is that we do indeed need to start worrying that our demand for food (and especially meat) in combination with increasing constraints on food supplies is increasing food insecurity for many of the world’s poor. Sure, the rich will be able to buy estate-grown coffee and organic lamb for a few decades more, but those poor people will be the source of both humanitarian (moral) crises and security risks for the rich.

H/T to Climate and Economy (I support them)

For the past ten years, Amsterdam has hosted a light show festival on the canals during the dark winter months. This show has been popular with locals and tourists alike, and people can see the lights from both land and water.

This year, due to the ongoing chaos of Covid (policy), most of the lights are turned off at 5pm, in line with Covid restrictions requiring that bars, restaurants, most stores and museums, and other tourism-related activities stop by 5pm.

But this makes no sense for an outdoor light festival. Why not leave the lights on and let people walk by (or come on their boats) to see them? Why not, since take away food and drink are allowed after 5pm, encourage small businesses to set up shop, selling drinks and food at some installations?

One reason why not might be is that the festival is primarily devoted to the interests of “business partners,” i.e., the boat companies looking for ways to attract tourists during the off season. (I hate these companies for their enormous, ugly floating blockades.)

Now I looked briefly at the financial statements of the stichting (non-profit foundation) that runs the festival, and I see that over 60% of its funds come from the city and ±15% comes from “sponsors,” but that would not be the first time that the city has subsidized tourism. (I was scanning quickly through the Dutch, so please comment on my mistakes or information I missed.)

What’s ironic (or “funny” as the Dutch would say) is that the current city government has vowed — after years of “please fuck, smoke and piss all over our city” promotions — that Amsterdam Tourism would spend less time on attracting foreigners and more time on engaging with citizens.

Turning off the lights at 5pm, at the same time as the boats stop running but NOT at the same time as residents wold want to enjoy their city, seems to contradict this message.

My one-handed conclusion is that Amsterdam has lost a golden (lit!) opportunity to make a Festival that truly serves its citizens and small businesses.

Update 10 Dec [in Dutch]: The lights will stay on until 10pm 🙂

H/T to MV

H/Ts to AW and PB

Sarah writes*

Mangroves are trees in tidal tropical and subtropical ecosystems that are essential for providing storm protection to coastal communities in over 120 countries and territories (Conway and Mazza, 2019). The Dominican Republic (DR) is one of these countries where mangroves have been vital for protection against storms and erosion (Bryony Cottam, 2021). In fact, conservationists in the province of Monte Cristi have seen a loss in shoreline, erosion and degradation in areas where mangroves have been removed (Bryony Cottam, 2021).

Even though mangroves are protected under the law in DR, weak enforcement has not stopped their removal (Bryony Cottam, 2021). Shrimp farms, fertilizer pollution, and other toxins have decreased mangroves by 30-50% (Chip Cunliffe, 2020).

This leads to the question: how do we encourage people to prioritize mangroves over tourism and agriculture?

Since tourism is one of the biggest industries in DR, it is more profitable to advance tourist infrastructure than protect mangroves (“Tertiary industries”, n.d.). Thus, there needs to be a value placed on the mangroves to incentivize protecting them. In the insurance industry, new products are emerging to cover the $1.5 trillion global “blue economy” (Conway and Mazza, 2019). Reinsurance companies such as Swiss Re implemented policies to protect dozens of km of coral reefs and mangroves in Mexico. These policies are putting a value on mangroves and coastal protection, which reduces the potential human and infrastructure loss. Axa XL also recognizes mangrove value. They found that a 100m-wide mangrove forest can reduce flood damages by US$65 billion per year since mangroves can reduce wave heights by as much as 66% (“Tertiary industries”, n.d.). Insurance companies will invest in mangrove rehabilitation when long-term benefits outweigh costs.

However, there are drawbacks to this insurance product. For one, insurance companies are likely to only provide coverage to areas that are mildly affected by global warming. Insurance companies are less eager to invest in protecting Dominican mangroves because there is more risk involved (Chip Cunliffe, 2020).

The second drawback is that pollution and over-fishing also contribute to the destruction of mangroves, which are difficult to value (Beck et al., 2020). Even if the mangroves are protected from being cut, they are not protected from pollution run-off. Additionally, over-fishing affects the balance of the food chain and, consequently, ecosystem health. Since it is difficult to quantify all the services that each aspect of an ecosystem offers, it is difficult to insure (Beck et al., 2020).

Although it is challenging, insurance companies such as Axa XL recognize the value of mangroves. They have already implemented policies in Mexico, and they are in the process of gauging the potential demand for an insurance product in the Dominican Republic and other locations in the Caribbean (Chip Cunliffe, 2020).

Bottom line: Mangrove protection is a nature-based solution to tropical storms that deserves investment. However, there are challenges in getting insurance companies to invest in countries that are highly affected by global warming. And it is difficult to implement a protection plan that not only prevents mangroves from being cut, but also reduces pollution and overfishing.

* Please help my Environmental Economics students by commenting on unclear analysis, alternative perspectives, better data sources, or maybe just saying something nice :).

Max writes*

As the price of EU carbon permits hits an all-time high of 70 euros per ton, questions of whether the EU Emissions Trading System (ETS) is living up to its promise are resurfacing.

The EU ETS, the world’s first emission trading system, was introduced in 2005 [pdf] to put a price tag on carbon emissions. The mechanism is built on cap and trade which assigns a finite number of carbon allowances to various greenhouse gas emitters in the aviation, electricity, and energy-intensive sectors of the EU [pdf]. The premise is that emitters who emit beyond their carbon allowances [pdf] must buy additional carbon permits from emitters who have not used up all their carbon allowances. As a result, excessive emitters are incentivized to reduce their emissions so that they do not incur additional costs. That is how it should work in theory; however, reality has shaped out to be completely different.

The EU ETS, the world’s first emission trading system, was introduced in 2005 [pdf] to put a price tag on carbon emissions. The mechanism is built on cap and trade which assigns a finite number of carbon allowances to various greenhouse gas emitters in the aviation, electricity, and energy-intensive sectors of the EU [pdf]. The premise is that emitters who emit beyond their carbon allowances [pdf] must buy additional carbon permits from emitters who have not used up all their carbon allowances. As a result, excessive emitters are incentivized to reduce their emissions so that they do not incur additional costs. That is how it should work in theory; however, reality has shaped out to be completely different.

To shield their industries from carbon paralysis, EU governments granted 99% of the carbon allowances between 2005 and 2012, or Phase I and Phase II of the project, for free — thereby giving up tens of billions of euros of potential auction revenue. This effectively made the cap-and-trade system void as emitters had no incentives to reduce their levels of pollution with the abundant supply of allowances. With the introduction of Phase III of the project, in 2013, this was set to change as permits would be primarily allocated through auctioning. Eight years later, they halved the number of free allowances; however, for most of the period, the price had been hovering between 5 and 15 euros per ton, considered by many economists as too low of a demand to incentive a significant change in emissions. Albeit, some studies justify the lack of demand as a sign of polluters moving towards less pollution, therefore they did not need additional allowances as the supply was ample enough to cover their needs. This leaves open the question of why did carbon prices double between 2020 and 2021 if the supply had not shifted that much?

The supply of allowances clearly remains way too abundant for major emitters to be incentivized to buy allowances. During Phase I and Phase II of the EU ETS the emissions of the 10 largest emitting sectors were 100% covered by free allowances, since 2013, there has been a gradual decrease to 60%. Despite a 40% decrease in free allowances, emissions, when accounting for emissions embodied in gross imports, i.e. gross leakage, have only decreased by 5-10%. In other words, the supply of free allowances remains far too ample to justify the EU ETS as an effective supply-constraining mechanism especially when considering that the majority of reductions were explained by the transition to natural gas from coal. Data for 2020 shows a familiar downward trend for emissions. Therein, the spike must have come from the demand side but not from emitters rather speculators. Speculators are anticipating that the price of permits will only continue to increase following the EU Commissions’ commitment in 2018 to pursue reductions more aggressively which has led to the price volatility that has been seen in recent years. In times of price volatility, emitters postpone investment in low-carbon technologies as market signals are not clear and jumps in the price can backfire on abatement efforts. In 2019, the EU introduced the Market Stability Reserve to soothe the worries of emitters, stabilize prices, and scare off the speculators; however, so far, the benefits have been scant.

Bottom line: The data for 2021, the year that carbon permit prices doubled, has not come in yet; therefore, the implications of the surge cannot be analyzed with certainty but, so far, ramifications in the EU have included a sharp increase in coal use (in response to permit price volatility) which can’t be good for the environment.

* Please help my Environmental Economics students by commenting on unclear analysis, alternative perspectives, better data sources, or maybe just saying something nice :).

Stephanie writes*

Anyone interested in sustainable food systems should be familiar with the First Nations’ “three sisters” farming method, which leverages synergies among maize, beans and squash. It’s often viewed as the archetype of polyculture.

Allow me to introduce a relatively new form of polyculture: the “three cousins” system for cultivating salmon, mussels and kelp. In 2004, a Canadian research project called AquaNet gave it a far less poetic name: IMTA (Integrated Multi Trophic Aquaculture).

Many believe IMTA could resolve the adverse impacts of salmon farming on marine ecosystems. Salmon farming is classified as monoculture because only one species is harvested. Typically monocultures suffer from unsustainable nutrient deficits, however, the issue with salmon farming is that they add nutrients to the ecosystem.

Is it possible to have too much of a good thing? Definitely! For decades, there have been concerns over excess salmon feed contributing to coastal eutrophication. Just Economics estimated this harm caused $29 million in damages to Canadian ecosystems in 2019.

One of the main contributors to early IMTA research, Thierry Chopin, argues that “the solution to nutrification is not dilution but conversion”. By uniting the “three cousins”, the Canadian salmon farming industry would be transformed from a throughput to a circular economy. Once farmers implemented IMTA technology, they would not only be absorbing the negative externality of nutrient waste, they would actually be profiting from it.

I swear it isn’t witchcraft, but something more magical: ecosystem services. Bivalves (such as mussels and scallops) are filter feeders. By placing mussel rafts around the salmon cage, they act as a buffer between the farm and the surrounding ecosystem. The mussels are fed by the excess nutrients from the salmon. A 2012 study found that mussels grown next to salmon cages are meatier than mussels farmed apart from salmon cages. Mussel and salmon farming are both prominent aquaculture sectors. It’s as simple as placing two already-existing aquaculture technologies side-by-side. The addition of kelp to the system provides another filter, via “nutrient scrubbing.” While there is no traditional market for kelp in North America, kelp demand is expected to increase.

The most daunting barrier to commercial IMTA implementation is the operational complexity, however supporters of IMTA push that these transition costs would be repaid with new revenue streams. Fish farmers should think of IMTA as an opportunity to diversify their investment portfolio.

Bottom line: Polyculture has real promise. Unite the three cousins. We’ll all be better for it.

* Please help my Environmental Economics students by commenting on unclear analysis, alternative perspectives, better data sources, or maybe just saying something nice :).

Juliet writes*

Policymakers and pro-climate groups want to address the climate crisis by replacing cars with internal combustion engines (ICEs) with electric vehicles (EVs). But can EVs be a true substitute for ICEs? Perhaps not. To fully grasp the potential benefits of EVs, it is important to know the extent to which EV owners actually end up driving them. This presents a challenge. Because EVs are primarily charged within homes, the existing charging data has been limited.

Policymakers and pro-climate groups want to address the climate crisis by replacing cars with internal combustion engines (ICEs) with electric vehicles (EVs). But can EVs be a true substitute for ICEs? Perhaps not. To fully grasp the potential benefits of EVs, it is important to know the extent to which EV owners actually end up driving them. This presents a challenge. Because EVs are primarily charged within homes, the existing charging data has been limited.

A 2020 study from the University of California – Davis [pdf] estimated that Californians drive their battery EVs 11,35o miles per year on average. These past analyses, however, were based on surveys and small sample sizes. Surveys are often inaccurate due to response bias, meaning that people have a tendency to respond to surveys with answers they believe to be more socially acceptable than true. This can be a subconscious phenomenon which skews the data. Small sample sizes can similarly affect data because a small subgroup may be unrepresentative of overall EV owners.

This year, another study at multiple universities including the University of California – Davis [pdf], using a much larger sample and direct measurements, indicates that EVs are being driven significantly fewer miles than their ICE counterparts. The study utilizes billions of California electricity meter measurements merged with address-level data about EV registrations in order to estimate the change in energy usage from EV charging. The result is an unexpectedly low change — a 2.9 kWh daily increase in electricity usage — signaling lower EV usage than previously thought. After adjusting for charging outside of the home, those results translate into battery EVs being driven only 6,700 miles per year. Data from the California Department of Public Health indicates that Californians as a whole typically drive around 9,000 miles annually.

The explanation for the low usage of EVs is not exactly clear, but the paper [pdf] cites a few possibilities. One possible explanation is that EVs might provide lower marginal utility per mile traveled when compared to ICE miles. The lower utility could stem from shorter distance range of EVs or insufficient charging networks. Another reason for less than expected charging could be that most EVs are owned by multiple-vehicle households. This would mean that EVs are a complement to ICEs instead of a substitute, and households who buy an EVschoose to drive their ICE more often than their EV. The last explanation I will touch on is that low charging rates could be a reflection of high electricity prices in California.

No matter the explanation, this information has important implications for future climate policy. The results indicate that policymakers should maybe reconsider making drastic commitments to EV technology in order to reach their decarbonization goals because it may not be as effective as it seems.

Bottom Line: EVs might not replace conventional gas-powered vehicles, so policymakers might need to pump the brakes on EV promotion until they have better information and instead focus on other ways to decarbonize society.

* Please help my Environmental Economics students by commenting on unclear analysis, alternative perspectives, better data sources, or maybe just saying something nice :).