The rapid growth of the Chinese economy in the wake of Mao’s death inspired both awe and envy across the world. From the 1980s onwards, the Chinese Communist Party (CCP) under Deng Xiaoping increased opportunities for private entrepreneurship leading to the so-called “Chinese Miracle.”

The economy was propelled forward through agricultural reform, export and huge infrastructure investments serving as engines of growth.

However, the characteristics of China’s transformation towards a middle-income economy presents lasting obstacles for growth and development in the long term. While China can be viewed as embracing capitalism, the private sector still occupies a minority share within the economy, with State Owned Enterprises (SOEs) still dominating the market. While these are responsible for a large share of the economic growth, their relative output often pales in comparison with their private sector counterparts.

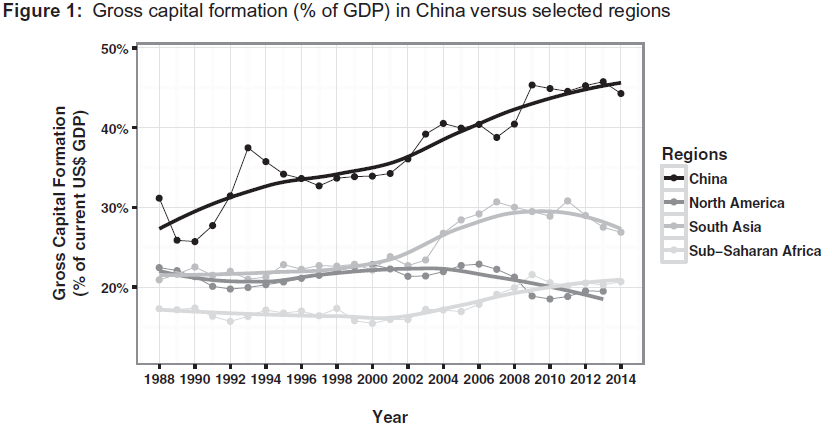

Additionally, SOEs have been able to stay afloat through the financial repression policies of the Chinese state, with massive injections of cheap credit being available within a giant investment boom as shown by Figure 1. These SOEs are able to access cheap credit because they are favored by the state-owned banks and seen as insured by the state. This has led to crowding out of the private sector, while simultaneously disincentivizing SOEs from innovation and increasing efficiency, causing many to become bloated and uncompetitive. This is due to the reluctance of the state and the banks to write off non-performing loans and restructure the SOEs due to entrenched opposition to reforms and fears of social unrest.

This lack of credit has led companies within the private sector to turn to shadow banking or seek external financing by becoming hybrid companies that can benefit from Foreign Direct Investment or access foreign capital markets by listing in Hong Kong.

Even though this system until now has served the CCP well in promoting growth, in recent years the economy seems to be slowing down, as diminishing returns on investment and uncompetitive companies have decreased growth figures.

Slow growth is especially problematic in state-supported sectors like green energy, where government-subsidized overcapacity resulted in dumping on foreign markets, and a lack of competition to incentivize efficiency and innovation. This is especially relevant in relation to the CCP’s “Made in China 2025” policy [pdf], which is aimed at creating internationally competitive firms in technology sectors. This plan can be impaired, as the industrial policy and especially investment allocation provided by the government suffers from information asymmetries and bias towards SOEs in both the government and the banking system.

Interestingly, a partial solution might be presented by China’s trade war with the United States, as President Trump’s drive against unfair competition threatens to close markets for Chinese industrial overcapacity. The lack of buyers for such goods could make the state’s current policies completely unsustainable and possibly force the state to change them.

With the lack of competition threatening further innovative growth, a possible middle-income trap looms. Unable to achieve technological upgrading and compete with the developed economies, the Chinese rapid economic engine could grind to a halt. Aside from the problem of diminishing growth figures, the CCP is simultaneously presented with demands for development concerning inequality, an ageing population, and environmental damage. Therefore, it might need to alter the way it sustains its political coalition, from economic growth towards addressing the countries other societal needs, all without getting cold feet.

Bottom line: It is time for China to deal with SOEs and non-performing loans, quit overinvestment, and put the country on a path of sustainable growth and development.

* Please help my Growth & Development Economics students by commenting on unclear analysis, alternative perspectives, better data sources, etc. (Or you can just say something nice :))

Overvaluation of real estate and overvaluation of the Stock market is also a problem. Many Chinese seem to have a little bit of a need to get their gambling fix, and those two markets provide that, and the risk doesn’t seem to register for a lot of them. Beijing also needs to keep their nose out of Hong Kong affairs. You can already see it in the way SCMP does their journalism and the political editorials (A newspaper which use to be hands down THE BEST in the region). Without good journalism cleansing the system it will be no time at all before Hong Kong becomes as corrupt as Beijing and also a place where “Laowai” are blamed for every sin under the sun. The changes in HK due to Beijing interference have really already been drastic, but it’s kind of like “the new normal” with donald trump in America, they don’t notice how drastic those changes have in fact been.

Sadly for me Professor Zetland, I found nothing wrong or weak with your analysis in this article, I will try harder next time. : )

Also interesting in the Hong Kong case is that it might actually hurt the Chinese Economy. Due to the restrictions of the Chinese legal and financial system it has been hart for many entrepreneurial undertakings to actually become competitive corporations. What some companies like the Chinese owned Lenovo, the biggest computer company in the world, have done is register themselves within HK and operate in China through subsidiaries, giving it access to a good capital market and legal status. This allowed the company to become a competitive capitalistic company. Changing HK to a Chinese city might damage this opportunity for companies and prove harmful for the development of internationally competitive national champions (which the Chinese government wants so badly) in the long run.